A generation ago, life in Singapore was straightforward. Graduate, get a job, buy a HDB flat for $40,000, drive a car with a $25,000 COE, build a life. Today? Graduate with honours, do seven internships, live with parents until 35, pay $612,000 for the same flat and $119,000 just for the right to buy a car.

We call this progress.

The generation that bought cheap is now in charge of pricing. They're not evil—they're just protecting what they've got. Unfortunately, what they've got is everything young people need.

This issue is brought to you by Wispr Flow

Typing wastes time. Flow makes voice the faster, smarter option everywhere.

4× quicker than typing. Dictate emails, docs, Slack updates, or code.

AI auto-edits. Filler words gone, grammar fixed, formatting intact.

Works everywhere. From Slack, Notion, Gmail, and ChatGPT to Cursor, Windsurf, and iPhone.

Smarter for teams. Snippet library drops in links, templates, or FAQs on cue.

Flow users save an average of 5–7 hours every week — full workdays back every month.

Give your hands a break ➜ start flowing for free today.

Housing: The Great Wealth Transfer

When older Singaporeans bought their homes for under $50,000, it was about shelter. Today, those same properties are worth $600,000+. That's a 1,200% windfall gain from policy-driven scarcity, not improvements or hard work.

Now these homeowners control housing policy. Any reform that makes housing affordable threatens their paper wealth. So affordable housing remains a nice idea that never quite happens.

Singapore's corporate boards average 62 years old, with 79% over 56. The people making housing decisions already own multiple properties. Asking them to prioritise young buyers over their portfolios is like asking landlords to vote for rent control.

The fix isn't complex: progressive property taxes that scale with portfolio size, capital gains taxes on investment properties, and direct housing grants for young people. But that would cost existing owners money, so it won't happen.

Transport: Pay to Play

COE prices jumped from $25,000 in the 1990s to $119,000 today—a 375% increase while salaries barely doubled. The people setting transport policy? They already own cars.

When COE reforms are discussed, who complains loudest? Current car owners worried about traffic, not the masses taking three buses to work. It's rational for them, devastating for everyone else.

Solution: separate COE categories for first-time buyers with subsidised rates. Will it happen? Ask the car owners running the committees.

The structural irony is profound: individuals already owning vehicles primarily determine vehicle accessibility for others. When reforms are proposed, resistance emerges from current motorists concerned about road congestion, not from people optimising multi-transfer public transport routes.

This represents a philosophical evolution from transport-as-infrastructure toward transport-as-exclusive-access. The shift isn't accidental. It's the predictable result of allowing beneficiaries to design access systems.

Careers: Musical Chairs with Fewer Chairs

New board appointments average 60 years old. Retirement ages keep extending. AI replaces junior positions while protecting senior roles.

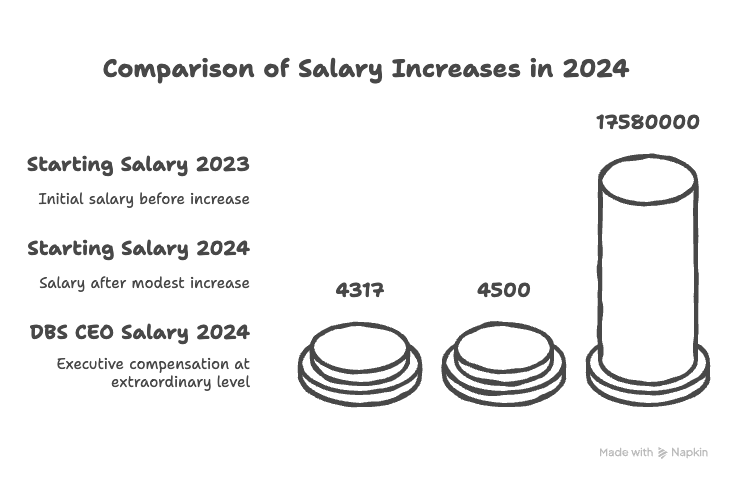

Graduate starting salaries grew 4.2% to $4,500 in 2024. CEO compensation hit $17.58 million. That's not a gap—that's a chasm designed by those at the top.

Young people aren't failing to launch—the ladder's been pulled up.

The Math is Brutal

Housing: 1,200% price increase since 1990

Transport: 375% COE increase since 1990s

Salaries: barely doubled in the same period

This isn't market forces. It's policy choices made by people who already succeeded under the old system.

Why This Matters

Young Singaporeans aren't asking for handouts. They're asking for the same opportunities their parents had. Instead, they get "character-building" lectures from people sitting on million-dollar properties.

The solutions exist: wealth taxes, progressive property taxes, subsidised access programs, and mandatory retirement from boards. But implementing them requires those in power to give up advantages.

That's the real question: Will the generation that benefited from cheap housing, cheap transport, and linear career progression step aside so their children can have similar chances?

The early evidence isn't promising. We've built a system where success depends on those already inside opening the door. And they're not particularly motivated to do so.

Young people deserve better than being told their financial impossibility is character building. They deserve systems that work for them, not just for their parents' generation.

The choice is simple: share the wealth or watch the next generation become permanent renters in the country their parents own.

Adrian Tan

Say hi 👋 on LinkedIn

WHENEVER YOU'RE READY, HERE ARE 3 WAYS I CAN HELP YOU:

No More Bosses - My book on the journey to sustainable self-employment

Fractional Marketing Lead for HR Tech Vendors - Looking to scale? Leverage my expertise in driving marketing strategies and business growth.

Promote to my 16,000+ subscribers by sponsoring my newsletter.

Want to ruin my day? No problem! Unsubscribe below.

Do you want to share your journey or have feedback? Just hit reply - I'd love to hear from you!